Expedite Your IRS Form 1023 For Your 501(c)3 Nonprofit Recognition

August 3, 2019

The IRS can take a few months to recognize a nonprofit’s 501(c)3 public charity status. Or, they could take FOREVER. It just depends on whichever agent you happen to get when they spin the magic wheel. If you read any of Bruce Hopkins’ work, the leading specialist on nonprofit law, you’ll see him rant about arbitrary requests and delays. Having been through this with the first nonprofit I started, I can testify to how annoying this is.

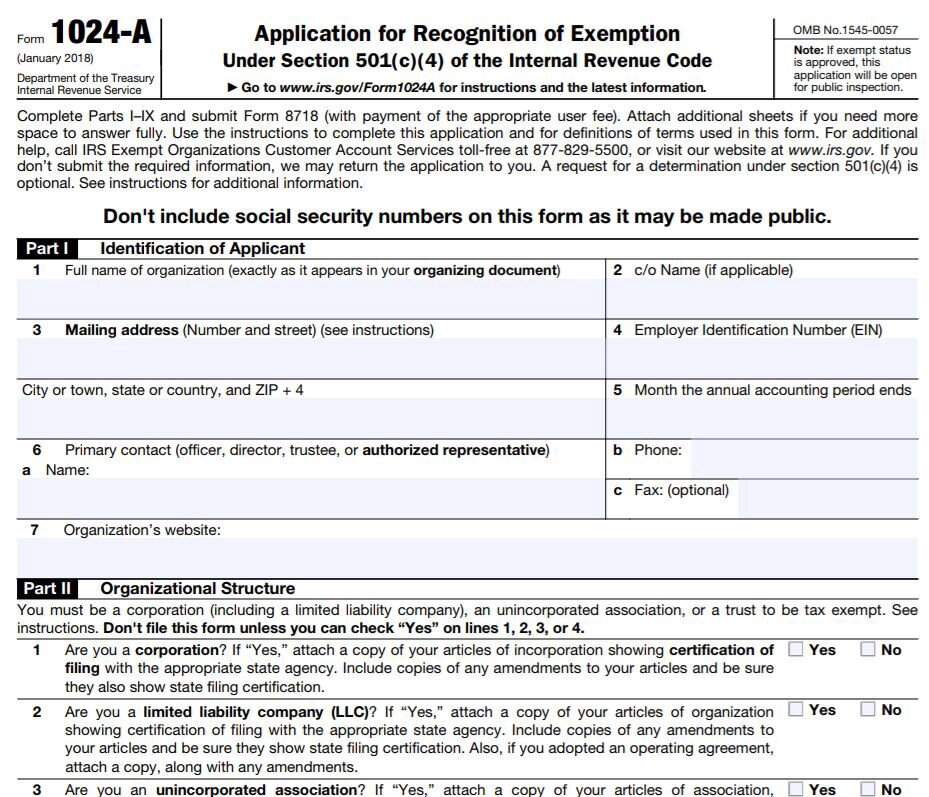

You can also read my article on Form 1024-A to learn how irritating it can be to be recognized by the IRS as a 501(c)4. That too may give you an idea of where I’m coming from. This stuff is way harder than it needs to be, and it appears to be designed that way.

Since my earlier days, however, I’ve learned some tricks. Like how to move to the front of the line if you need the IRS to recognize your status in a hurry. You can also do an expedited request if you suspect the IRS is going to make a long series of arbitrary requests like doing a specific number of donuts in the parking lot. The clearest approach to expedite your request is if you’re expecting a large grant — which is what we’ll be talking about. And yes, you’ll need a large donor for this. Follow Claire Axelrad or Laura Fredricks (her book The Ask is great) if you need help on fundraising.

Here are the elements for an expedited request due to an expected grant:

A grantor (person or organization) committed to giving the grant or asset,

The amount of the grant or the value of the asset is substantial,

There’s a specific date that the grant will be forfeited or permanently redirected if 501(c)3 status is not recognized,

There is a compelling impact on the organization’s operations if it does not receive the grant/asset, and

The expedite request letter must have a signature of a principal officer or authorized representative.

And here’s the IRS page on the topic, which includes where to mail the letter. I’d recommend including the Grantor’s grant agreement as evidence. You can include this phrasing in the grant agreement:

Grantee’s Tax Status. This grant is expressly contingent on Grantee being awarded 501(c)3 recognition from the IRA before Date Here. Under no circumstances will Grantor otherwise award this grant to Grantee.

Grantee must not be classified as a “private foundation” as defined in Section 509(a) of the Code, or “Type III” supporting organization as described in Section 509(a)(3)© of the Code (other than a (functionally integrated” Type III supporting organization as defined in Section 4943(f)(5)(B) of the Code).

Grantee will submit to Grantor a determination letter of tax exemption issued by the Internal Revenue Service and will represent that the letter has not been revoked or modified. Grantee agrees to notify Grantor immediately of any changes in its tax status during the term of the grant.

One question you may be asking is how large the grant has to be. The IRS’s answer is vague, which should come as no big surprise. The IRS says the expected grant should be more than 1% but probably not more than 50% of the applicant organization’s good faith expected annual revenue (within the year applying). Personally, I’ve been approved with a number over 10%. But don’t forget that the IRS reserves its ability to be completely arbitrary on whether it grants your expedite request.

You may be thinking how nice it would be if that request letter was just drafted for you. I mean, you’re probably stressed out about all this stuff anyway, right? Lucky you, I’ve taken a copy of the letter I successfully used and put it on my website for download as an open text document. (This uses components from the Form1023.org resource, which I’ve referenced at the end.)

Good luck!

Extra Notes:

If you’re doing a 1023-EZ, you can’t do an expedited request. You file that form if you expect to stay a real small fry nonprofit. I’d recommend that you use this expedite approach only if you actually need to.

If you want help filling out the Form 1023 on your own, then I highly recommend checking out 1023.org. Make a donation there (far cheaper than an attorney) and you’ll get a lot of great resources.

The publisher NOLO does a really nice job helping folks with the initial stages of starting a nonprofit. You should have this book as a guide.

Looking for governance documents? Try the transparency page at The Center for Election Science to find some examples.